PLUSVALIA TAX: NEW REGULATION 2021

Following the Spanish High Court ruling, the Spanish Government has urgently approved a new method of calculating Plusvalia tax, to minimize the legal vacuum that this nullity has produced.

WHEN PLUSVALIA SHOULD BE PAID?

The municipal capital gains tax is paid to Spanish municipalities when the taxpayer:

- Sells

- Inherits

- Receives a home as a donation

WHY PLUSVALIA WAS NULL?

The Spanish Constitutional Court in its Sentence 182/2021 of 26th October 2021, published on 3rd November, declared unconstitutional and null the method used to calculate the taxable base of the municipal capital gains tax, that is, the amount on which the tax is applied.

The decision affected all the sale and purchase operations signed after the Judgment (26th October 2021) and the appeals submitted and still pending of resolution at 26th October.

The Spanish Constitutional Court arguments say that the calculation of the tax base was made with fixed parameters, which did not always respect the capital gain actually obtained, therefore it declares them null.

The Judgment considers that these norms are unconstitutional due to the fact that they establish “an objective method for determining the taxable base of the Tax on the Increase in the Value of Urban Land, which determines that there has always been an increase in the value of the land during the period of the taxation, regardless of whether there has been such an increase and the actual amount of that increase”.

The Supreme Court considers that the tax violates the principle of «economic capacity«, guaranteed by article 31 of the Constitution.

WHICH ARE NEW PLUSVALIA RULES?

After a brief period of legal vacuum, during which those who have sold a property will not have to pay the tax, a new law (RDL 26/2021) was approved by the Council of Ministers on 10th November 2021 which settled a new calculation system.

With this new resolution of 2021 the city councils are exposed to having to return all the amounts that had been contested, pending resolution, whether the claim was raised by administrative or judicial means.

The new sentence will affect all those operations signed from now on or the cases that are already appealed.

But it will not have retroactive effects for situations in which there is no longer the possibility of filing an appeal or when appeals were firmly rejected in the past.

The legal gap between the date of declaration of the unconstitutionality of the calculation method (October 26) and the entry into force of the law with the new calculation method (November 10), will benefit those who have sold a property in that period time and those who have recently sold and are in time to file a self-assessment.

SHOULD I HAVE TO PAY PLUSVALIA?

You will have to pay Plusvalia depending of the date of the sale, inherit or donate:

A.- Tax accrual date before 26th October 2021:

Due to the Spanish Constitutional Court judgement on 26th October 2021, you will not pay Plusvalia, however, the taxable person is obliged to present a tax declaration, if it has not been presented before said date, in order to record the realization of the taxable event and to be able to register the deed in the Property Registry.

B.- Tax accrual date between 26th October and 9th November 9 2021.

Due to the legal vacuum/gap caused between the Sentence 182/2021 and the entry into force of RDL 26/2021, the Plusvalia cannot be paid. However, the taxable person is obliged to present a tax declaration, in order to record the realization of the taxable event and to be able to register the deed in the Property Registry.

C.- Tax accrual date after 9th November 2021.

C.1.- For all those who find themselves in this situation, the rule allows choosing one of the two methods of calculating the taxable base established therein.

The 2 methods are:

– Direct estimation (“estimación directa”).

– Objective estimation (“estimación objetiva”).

Based on what it considers the most favorable option, the taxable person can choose the calculation method by which he/she wants to calculate the taxable base of the tax.

The calculation method by direct estimation will only be applied at the request of the interested party.

Therefore, the taxable person must indicate in his/her request the chosen calculation method, if this does not expressly express his/her will, the City Council will apply the calculation method by objective estimation.

C.2.- Case of Non-subjection due to non-existence of increase in value:

The tax will not be paid when there is no increase in value due to the difference between the transfer and acquisition values (It must be accredited by the taxpayer by providing the titles deeds from the transmission and the acquisition).

D.- For all mentioned cases, as established the Law:

1.- The taxpayers will be obliged to present to the corresponding City Council the declaration determined by the respective ordinance, containing the elements of the tax relationship that are essential for the proceeding liquidation.

2.- Said declaration must be presented in the following terms, counting from the date on which the tax is accrued:

a) In the case of “inter vivos” acts, the term will be 30 business days.

b) When it comes to acts due to death, the term will be 6 months, extendable up to one year at the request of the taxpayer.

HOW CAN I CALCULATE PLUSVALIA?

There are 2 methods of calculation for Tax accrual date after 9th November 2021:

A) Direct estimation (“estimación directa”).

The Tax Base is calculated on the difference of the transfer value and the acquisition value.

The values that appear in the respective titles deeds will be taken (without adding expenses or taxes).

X = Transmission value – acquisition value

In the case of the transfer of a property in which there is land and construction, the value of the land will be taken as the value of the land for the calculation of the Taxable Base, the result of applying the following formula:

Once we have X, we must go to the value of the land according to the IBI in force at the time of accrual of the capital gain, and calculate the percentage that this supposes on the total cadastral value, giving (Y%)

Once we have X we apply the percentage Y% to calculate the tax base.

B) Objective estimation (“estimación objetiva”).

The value of the land value will be based on the values established at the IBI tax receipt (Annual Council tax), at the time of accrual of the capital gain.

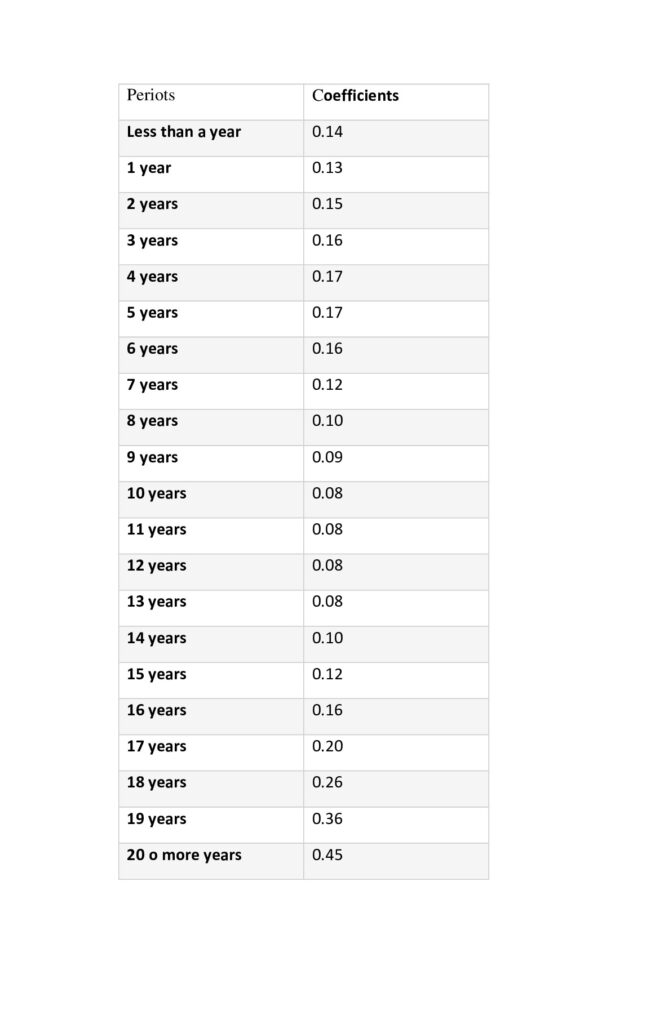

The tax base will be the result of multiplying the land value by the existing coefficient in the table approved annually, for that number of years.

The number of years will be, except in special cases, the number of years elapsed between the date of acquisition and the date of transmission. Except for periods of less than one year, the number of years will be considered without fractions.

EXAMPLES:

Direct estimation example:

Value when you bought in 2017 = € 310,000

Value when you sold in 2021 = € 350,000

(X) = 350.000-310.000 = € 40,000

Total “Catastral” value (IBI bill) = € 100,000

Valor del land (IBI bill) = € 60,000

The value of the land is the 60% of the total Catrastral value (Y%)

TAX BASE = X * Y%

TAX BASE = 40.000 * 60% = €24,000

Plusvalia tax =24.000 * 30% = €7,200

Objective estimation example:

Sale date: 12nd December 2021

Purchase date: 5th July 2017

Years: 4

Coefficient (table): 0.17

Total “Catastral” value (IBI receipt) = €100,000

Valor del land (IBI receipt) = €60,000

TAX BASE = Value of the Land * table coefficient (regarding years)

TAX BASE: 60,000 * 0.17 = € 10,200

Plusvalia tax = 10,200 * 30% = € 3, 060

Do not hesitate to contact REUTERS SOLICITORS for more information.

Contact us:

REFERENCES:

-Alicante Town Hall website: https://www.alicante.es/es/tramites/circular-informativa-plusvalia-municipal-sentencia-1822021-del-tc-y-rd-262021