INTESTATE INHERITANCE IN SPAIN

In Spain, we call “inheritance process” to the Probate.

If there is no will, the inheritance is known as “intestate” inheritance process.

If one of your relatives has passed away in Spain, do not hesitate to contact REUTERS SOLICITORS.

We provide a complete probate service in order to relieve relatives of this tough and stressful situation.

CAN A RELATIVE PASSES AWAY WITHOUT WILL?

Yes, a person can die without will.

Wills/testaments are not mandatory in Spain.

You can read more about wills in this link.

If there is no will, the inheritance is known as “intestate” inheritance.

An intestate inheritance is ruled by Spanish Law which says who will inherit the estate.

WHO INHERITS WHEN THERE IS NO WILL?

In an intestate inheritance, Spanish Law sets that beneficiaries are:

FIRST: The descendants

SECOND: The ascendants

THIRD: The spouse

FOURTH: The siblings

FIFTH: The aunts and uncles

SIXTH: The nephews

If there are no relatives, the estate is inherited by the Spanish State.

HOW IS THE INTESTATE INHERITANCE PROCESS?

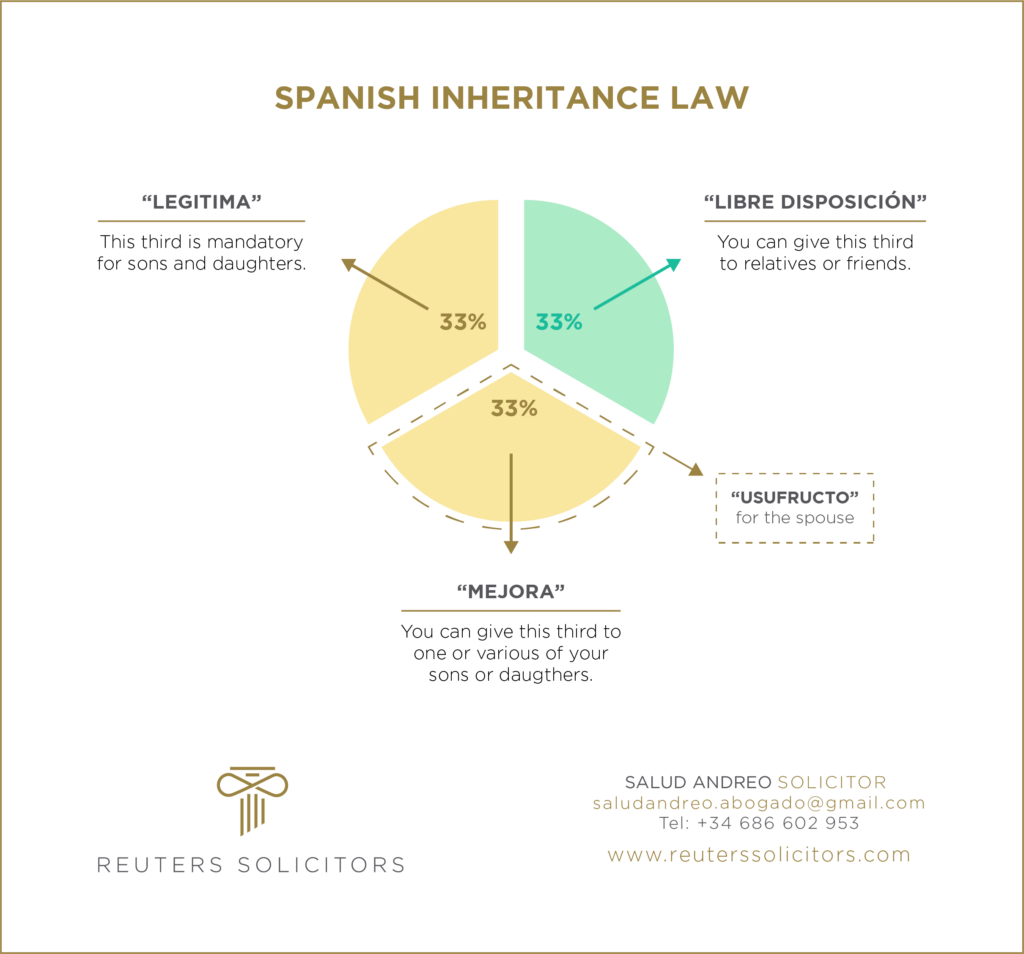

If there is no will ruling the inheritance, Spanish Law says that two thirds of the decease´s assets must be for the descendants. The last third can be distributed among any beneficiary.

WHAT SERVICES INCLUDE REUTERS SOLICITORS?

REUTERS SOLICITORS will deal of the whole process of probate.

The service includes:

- Legal advice of the whole process of probate in Spain.

- Drafting a Power of Attorney in order to avoid the need to travel to Spain

- Obtaining NIE certificates for all beneficiaries

- Obtaining requested documentation for probate.

- Obtaining a copy of the will in case there is one.

- Obtaining information about assets in Spain (properties, cars, life insurances, jewellery, bank accounts…)

- Obtaining information about debts in Spain (mortgages, loans…)

- Preparing probate deeds at the Notary.

- Signing probate deed on behalf of beneficiaries.

- Submission of inheritance taxes before Spanish Authorities.

- Distribution or sale of assets

WHICH IS THE INHERITANCE TAX?

Every beneficiary of an inheritance is obliged to pay taxes in Spain.

There are 17 different rates, as each Spanish region rules this tax.

Moreover, the tax varies depending on how far the beneficiary is from the deceased (i.e.: a son pays less taxes than a friend).

REUTERS SOLICITORS provides Probate service to international clients.

Do not hesitate to contact us for a FREE CONSULTATION.

RELATED ARTICLES