In this blog we will explain you the main points of a mortgage for non residents in Spain.

If you are thinking of purchasing a property with finantiation/mortgage in Spain, this is the blog you need to read.

How much can you borrow in Spain?

When you are a non-residential borrower, Spanish banks will only be willing to lend up to 50% – 60% (figures updated February 2019). However, there are some and very specific cases where banks will lend you 70%, but it will be after a long negotiation and study of your particular case.

Most of the cases, mortgages are based on the purchase price; however, there are cases where it is on the bank assessor’s valuation of the property.

How to apply for Spanish mortgages

It is important to inform you that mortgage process can take from 4 to 6 weeks to be completed. While the official mortgage process can only start after a sales agreement has been reached, it is advisable to start developing your mortgage as soon as possible.

You will not be able to purchase until the lender and borrowers have agreed the mortgage terms and the documentation is prepared to be signed.

Reuters Solicitors advises to compare different mortgage offers from different lenders. Conditions, terms and commissions may vary from one to another.

Interest rates

Banks offer two possibilities:

- Variable mortgage: which are linked to the Euribor* plus an interest (i.e.: Euribor + 3%)

*Euribor is an European rate.

- Non variable mortgage or fixed mortgage: You will pay a fix interest during the length of the mortgage.

The decision about with option is better will depend on the interest offered, the length of the mortgage, the amount due, etc. In Reuters Solicitors we advise to ask for two different simulations (fix and non fixed mortgage) in order to compare them and see which option fixes you better.

Deciding between one and the other option will save you money in the long term.

Cost of the Spanish purchase and mortgage

When you buy a property in Spain, you need to take into account that the property transaction cost will be 10-12% of the property value.

Until 2019, the cost of the transaction was 10-15%; however, the cost has been reduced due to a High Court Sentence (*1).

Purchase taxes

The tax from the purchase is called “Impuesto de Transmisiones Patrimoniales (ITP)” and it is paid by the buyer.

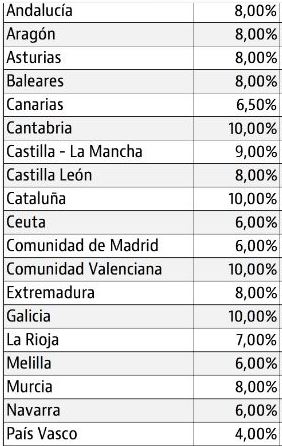

The tax varies depending of the region of Spain where the property is located at:

Spanish Law says that buyers have one month after the signing at the Notary in order to pay this tax (ITP) through Tax Authorities. It is essential to fill a Form (called Modelo 600).

In the last years, bank lenders have hired the services of external departments called “Gestorias” who are in charge of all payments. The bank (lender) provides borrowers a budget of costs previous to the signing of the deeds at the Notary and this quotation is withdraw from the borrowers bank account previous the date of the signing.

Once all payments are made, the “Gestoria” will refund the borrowers the remaining amount.

If you purchase a property without mortgage, you do not need a “Gestoria” to deal with all payments. For this reason, we advise you to hire the services of a solicitor who will take care of all the process.

Mortgage expenses (*1)

Until 2018, mortgage expenses (Notary, Land Registry and taxes) were paid by borrowers, however, due to a High Court Sentence; bank lenders have assumed these costs in 2019.

Thus, the total cost of the operation has decreased up to 2.5% – 3%, which is quite beneficial to borrowers.

To take into account

Before buying a property in Spain, you will need a NIE number (“Número de Identificación de Extranjeros”) which is the Spanish identification number for foreigners.

It is mandatory to obtain the NIE for purchasing a property or get a mortgage.

NIE is applied at the Police Station Offices and it requires some documents:

- Fill Form EX-15

- Copy of your passport pages and original passport

- Two passport sized photos

- Pay tax Form 790 (€10)

If you are not able to travel to Spain, Reuters Solicitors can assist you with the NIE by signing a Power of Attorney to act on your behalf.

Requested Documentation to apply for a Spanish mortgage

When you go through Spanish mortgage lender, you will need the following items:

- Passport copy/ies

- NIE number

- Proof of income

- P60

- Details of your current debts and mortgages (Credit Report)

- Records of your current assets

- Any prenuptial agreements (if applicable).

Once you submit your completed file to the bank lender and the bank manager has checked all the requested documentation, the bank will make you a mortgage offer. As previously mentioned, this may not be the bank’s ‘best’ offer, so don’t be afraid to take it to a competitor. Often the competitors will try to provide you a better offer, which you can then take to the original bank to see if they are willing to improve their original offer.

Once you have decided the suitable mortgage and the purchase is prepared, seller and buyer will decide the date of the signing which will take place in front of the Spanish Notary. The Notary will stamp his signature at the purchase deeds and the mortgage deeds. As soon as the notary certifies that all the documents are in order, the deeds are ready for taxes.

Property insurance in Spain

All Spanish property owners are legally obligated to have home insurance to cover the value of the property. Life insurance is not mandatory but many lenders require borrowers to take out life insurance policies sufficient to pay off the outstanding mortgage balance in case of disease or death.

Extra costs of applying for a mortgage

Although we have said that mortgage expenses will be paid by the bank, we need to highlight that the process has another costs such us: opening commission by the lender (commission that you pay when the mortgage is agreed, which will be between €900 and €1,500 approx.), valuation/appraisal of the property by an independent valuator company (around €400), and Spanish translator and legal advisor or solicitor (if applicable).

A piece of advice

We recommend to hiring the services of a solicitor who will deal with all the issues related to the purchase and mortgage. A solicitor will handle the property transaction checking whether the property meets every legal requirement, he will revise the contract to make sure there are no abusive clauses and we will guide you throughout the whole process.

Moreover, a solicitor will take every step to guarantee that your property is properly registered before a notary and in the Land Registry.

Regarding the mortgage issues, a solicitor will find the best finantiation for you, by comparing bank´s offers, budgets and mortgage conditions.

Example

Reuters Solicitors gets proper mortgage offers from clients. In February 2019, we get this mortgage offer for one of our clients:

Purchase price: € 250,000

Mortgage: € 175,000

Finantiation: 70% (as previously mentioned, Spanish banks are only willing to lend up to 50–60%. However, after a long negotiation with the bank, we got 70% finantiation for the client).

Length: 20 years

Fix interest: 2.85%

Breakdown of expenses: € 27,300 approx.

- Expenses for the mortgage:

- Taxes: €0

- Notary: €0

- Land Registry: €0

- Gestoria: €0

- Valuation/appraisal of the property: €400

- Expenses for the purchase:

- Taxex: 25,000 (10% of purchase price in Comunidad Valenciana)

- Notary: €1,000

- Land Registry: €500

- Gestoria: €400

Do not hesitate to contact us for more information:

https://www.reuterssolicitors.com/contact-us/

Related articles about Purchasing in Spain: